PRUDENTIAL Associates is a consulting and solutions company operating since 1972. We offer a wide range of services within the top-level categories of security, digital forensics, cybersecurity, investigations and risk management.

For more than five decades PRUDENTIAL Associates has served the needs of corporate clients, government agencies, and members of the legal community; these clients depend heavily on our company to be their “intelligence and threat management division”, as well as their source for technology expertise. Our investigative and technology professionals are nationally recognized as the preeminent experts in their fields.

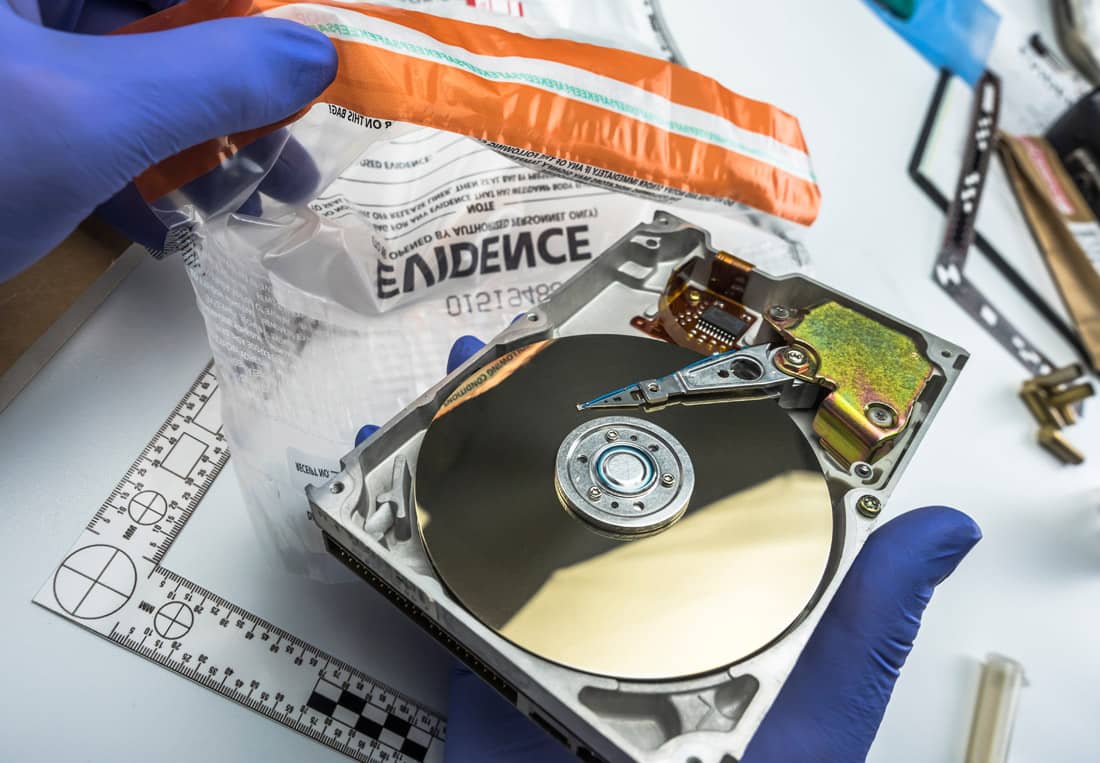

We deliver the absolute “best you can buy” in the extreme knowledge and skills market. NO other resource marries professional law enforcement/intelligence agency investigative acumen with the highest skill cybersecurity and digital forensics knowledge the way we do.